A powerful Gulf Coast storm just hit—now what?

If you’re staring at shingles in your yard or water stains on your ceiling, you’re not alone. Storm damage on the Mississippi Gulf Coast is a reality many homeowners face, and the emotional and financial strain it causes can be overwhelming.

Between high winds, driving rain, and flying debris, your roof often takes the brunt of the storm. But the real stress begins after the skies clear—figuring out how to properly file an insurance claim. Many homeowners unknowingly make mistakes in these first few days that cost them thousands later on.

That’s why we put this guide together. As a trusted roofing contractor MS Gulf Coast residents rely on, we’ve helped countless homeowners navigate this process. This step-by-step breakdown will show you how to document damage, work with your insurance provider, and make sure your roof is restored the right way.

Step 1: Review Your Insurance Policy

Before making any calls or repairs, start by reviewing your homeowner’s insurance policy.

Check to see if your policy includes storm-related coverage—specifically for wind, hail, and hurricane damage. Some policies may also exclude certain types of damage, such as cosmetic issues or flooding, which typically requires a separate policy.

Next, locate your deductible amount and any coverage limits. This will help you understand your out-of-pocket responsibility and prevent sticker shock later in the claims process.

Pro Tip: Save a digital copy of your insurance documents in a secure cloud folder and print a physical copy in case you lose power or internet access after a storm.

Understanding your coverage upfront is crucial. It ensures you’re better prepared when you begin the claim process—and gives you the confidence to advocate for yourself as you work with your insurer and a qualified roofing contractor Gulfport MS homeowners trust.

Step 2: Document the Damage Thoroughly

Once it’s safe to go outside, begin documenting the damage immediately.

Start by taking clear, high-resolution photos and videos of your roof and any other affected areas of your home and property. Be thorough—capture wide shots to show the full scope, along with close-ups of damaged shingles, flashing, gutters, soffits, or debris punctures.

If you can safely access your attic or interior ceilings, document signs of water leaks or moisture intrusion as well. This visual evidence will support your claim and make it harder for insurance adjusters to overlook key issues.

Create a log that includes:

- The date and time of the storm

- The type of weather event (hail, wind, hurricane)

- A description of what you observed—missing shingles, broken vents, visible leaks, etc.

Lastly, keep receipts for any temporary repairs or supplies like tarps, nails, or plywood. These may be reimbursable and also show you acted quickly to prevent further damage.

Taking these steps early—especially with guidance from a reliable roofer near me—can significantly improve your chances of a fair insurance settlement.

Step 3: Notify Your Insurance Company Promptly

Once you’ve reviewed your policy and documented the damage, the next critical step is to contact your insurance company. Most homeowners’ insurance policies require prompt reporting after a storm, and any delay could result in your claim being denied or reduced.

When you call, have your policy number, the date of the storm, and a brief summary of the damage ready. The insurer will open a claim and assign a claim number—be sure to write this down and use it in all future communications.

Keep a record of:

- Who you spoke with

- What was discussed

- The date and time of your conversation

Timely reporting not only fulfills your policy requirements but also helps you get in line early for inspections and repairs, which is critical when storms impact hundreds of homeowners in areas like the MS Gulf Coast. If you’re unsure what to say or need help navigating the process, a trusted roofing contractor Gulfport MS homeowners rely on can offer assistance during this initial outreach.

Step 4: Schedule a Professional Roof Inspection

After your insurance claim has been filed, it’s essential to schedule a roof inspection with a licensed professional—ideally someone experienced in storm damage assessments.

A professional roofing contractor MS Gulf Coast residents trust will know how to identify both visible and hidden damage, such as:

- Compromised flashing or underlayment

- Loose or missing shingles

- Damaged vents or chimney caps

- Leaks not yet visible inside the home

The contractor should provide a detailed, itemized estimate of the necessary repairs or full replacement, including labor and materials. This estimate is critical for comparison when the insurance adjuster conducts their own inspection.

Having your roofer present during the adjuster’s visit can make a significant difference. They can point out technical issues, advocate on your behalf, and ensure the adjuster doesn’t overlook any key damage that could affect your claim payout.

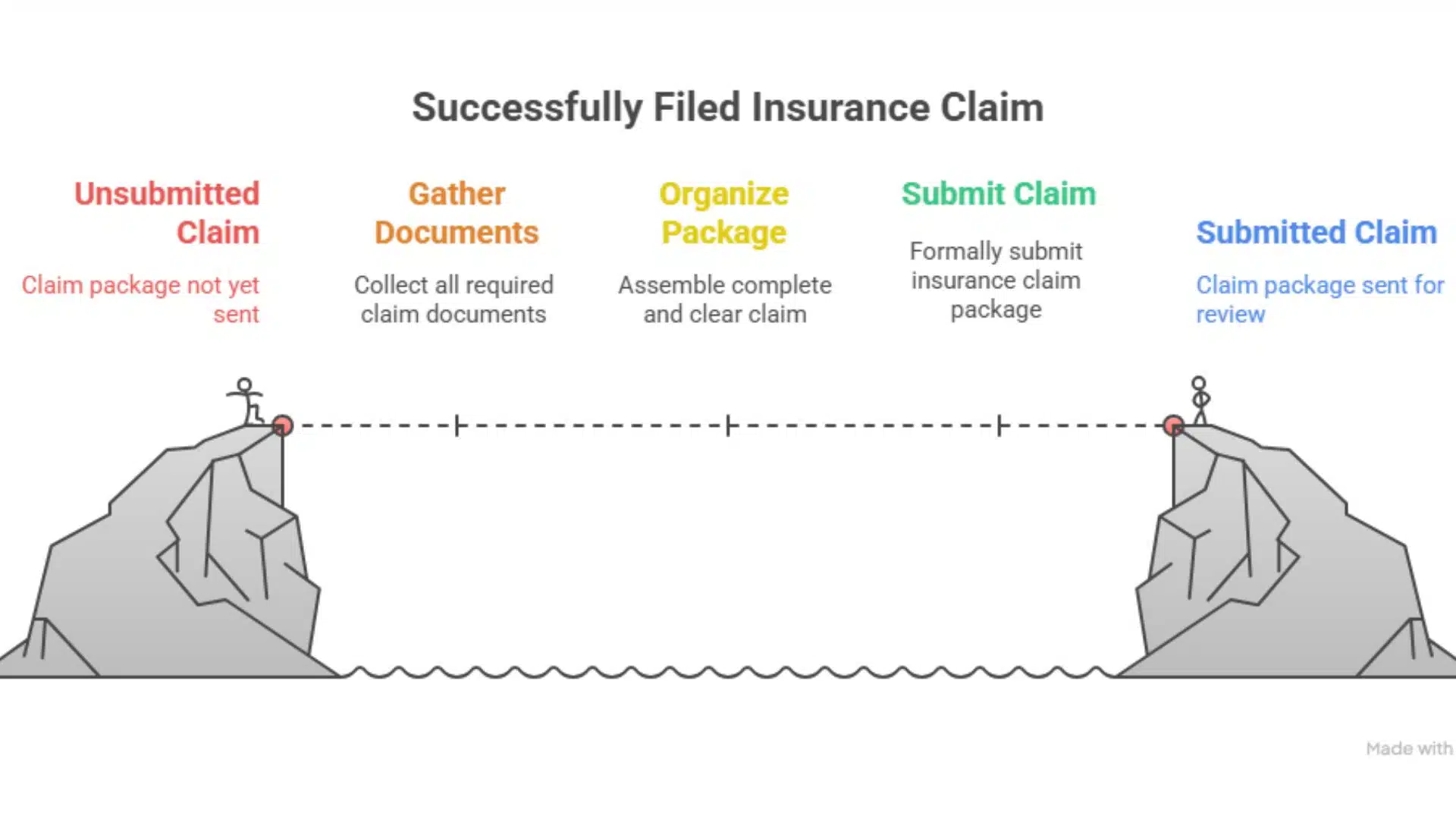

Step 5: File the Insurance Claim

Now that you’ve gathered all the necessary evidence and documents, it’s time to formally submit your claim.

Your claim package should include:

- Photos and videos of the damage

- Notes and timelines you recorded after the storm

- Your roofing contractor’s inspection report and estimate

- Proof of ownership (like a mortgage statement or deed)

- Receipts for temporary repairs or emergency expenses

Also include documentation of any additional living expenses—such as hotel stays or meals—if your home became uninhabitable due to storm damage. These may be covered under your policy’s “Loss of Use” provision.

Submitting a complete and well-organized claim package helps minimize delays and reduces the chances of pushback from the insurance company. Partnering with a roofing contractor MS Gulf Coast homeowners already trust for quality and professionalism can give your claim added credibility from the start.

Step 6: Meet With the Insurance Adjuster

Once your claim is submitted, your insurance company will schedule a visit from an adjuster to assess the damage in person. Be present for this inspection.

Why? Because no one knows your home like you do—and no one will advocate for your property like you and your roofing contractor will.

During the inspection:

- Walk the adjuster through all areas of damage.

- Provide your photos, videos, receipts, and written notes.

- Share your contractor’s inspection report and repair estimate.

Pro Tip: Ask your roofing contractor MS Gulf Coast expert to be present during the adjuster’s visit. They can point out less obvious damage, explain technical issues, and ensure no critical items are missed or undervalued in the adjuster’s report.

The adjuster’s findings will heavily influence your settlement offer, so it’s important that they get a complete and accurate picture of the damage from the start.

Step 7: Make Temporary Repairs and Track Expenses

While you wait for your claim to be approved, you may need to make temporary repairs to prevent further damage. This is especially important after heavy Gulf Coast storms, where ongoing rain or wind can quickly worsen the situation.

Acceptable temporary repairs include:

- Tarping damaged areas of the roof

- Boarding up broken windows

- Using plywood to cover exposed areas

Do not begin permanent repairs until the adjuster has inspected the property. Starting too soon could jeopardize your claim or result in denial for lack of documentation.

Keep all receipts for materials and labor related to temporary work. Additionally, if your home is unlivable and you’re forced to stay in a hotel or eat out, save those receipts too. These expenses may be covered under your policy’s Additional Living Expenses (ALE) clause.

As a roofer near me with years of experience, we often help clients secure reimbursements by keeping detailed records and photos of their temporary fixes.

Step 8: Negotiate and Follow Up

After the adjuster’s inspection, you’ll receive a settlement offer from the insurance company. But don’t assume the first offer is the final word—many initial estimates are lower than what’s needed to restore your roof properly.

If you believe the offer is too low:

- Share additional documentation (photos, contractor estimates, receipts).

- Politely request a second inspection if something was missed.

- Ask your roofing contractor to communicate directly with your insurer for clarification.

If necessary, you can also:

- Hire a public adjuster to review the claim

- Consult a local attorney who specializes in insurance disputes

The goal is to reach a fair settlement that reflects the full scope of storm damage. At Integrity Roofing, we’ve worked alongside homeowners throughout the MS Gulf Coast to make sure their roofs are repaired correctly—and their claims don’t fall short.

Final Step: Approve Repairs and Finalize the Claim

Once your claim is approved and you’ve accepted the settlement, it’s time to schedule your roof repair or replacement. Choose a reputable roofing contractor Gulfport MS homeowners trust—ideally, the same one who helped you through the inspection process.

Here’s what to do next:

- Confirm that the scope of work matches the settlement amount

- Sign a written agreement outlining the timeline, materials, and labor

- Monitor the repair process to ensure quality and code compliance

Do not close out the insurance claim until the job is complete and you’re fully satisfied with the results. It’s your right to ensure that the repair was done thoroughly and professionally before finalizing anything with your insurance company.

Keep all documentation related to the repair—including receipts, contracts, and communication with your contractor and insurer. This paper trail may come in handy for future policy renewals, claims, or real estate transactions.

At Integrity Roofing, we walk our MS Gulf Coast clients through this final step with the same level of care and transparency we provide from day one. After all, getting your roof fixed is only part of the goal—we want you to feel protected and confident in the result.

Common Reasons for Claim Denial

Even after a major storm, insurance claims can be denied for reasons that are often preventable. Here are the most common issues we’ve seen homeowners run into on the MS Gulf Coast:

1. Inadequate Documentation

Failure to provide clear, dated photos or a detailed damage report can lead to rejection. Always document everything from multiple angles—and include timestamps whenever possible.

2. Delayed Reporting

Most insurance policies have strict timelines for filing a claim after storm damage. Waiting too long to notify your insurer—even if the damage appears minor—can invalidate your claim.

3. Policy Exclusions

Standard homeowner policies may not cover all types of storm damage. For example:

- Flooding usually requires separate flood insurance

- Cosmetic damage may not meet the threshold for coverage

4. Making Permanent Repairs Too Soon

If you fix your roof before the adjuster inspects it, you risk losing coverage. Only make temporary repairs to prevent further damage, and photograph everything before and after.

5. Failure to Maintain the Roof

Insurance companies can deny claims if they determine that pre-existing wear and tear—not storm impact—was the real cause of damage. That’s why regular inspections from a roofing contractor MS Gulf Coast homeowners rely on is critical, even before hurricane season hits.

✅ Ready to Protect Your Home and Your Claim? Let’s Talk.

At Integrity Roofing, we know how stressful storm damage and insurance claims can be—especially here on the MS Gulf Coast, where weather can turn quickly and damage escalates fast. That’s why we’re here to help every step of the way, from documenting your roof damage to meeting with your adjuster and completing expert repairs.

Whether you need a detailed inspection or trusted guidance through your claim, our team is ready to serve. We’re the roofing contractor Gulfport MS and surrounding homeowners rely on when integrity, speed, and quality matter most.

📞 Call us today at (228) 295-8300

🌐 Visit roofsbyintegrity.com

📍 Serving the entire MS Gulf Coast

Don’t wait until a small leak becomes a bigger problem. Get the protection and peace of mind you deserve—start with Integrity.

Frequently Asked Questions

1. How soon should I file a roof insurance claim after storm damage?

You should file your claim as soon as it’s safe to do so. Most insurance policies on the MS Gulf Coast have strict deadlines for reporting storm damage—often within 30 days. Delaying your claim can result in a denial, so it’s important to document the damage promptly and contact your insurer right away.

2. Will my homeowner’s insurance cover all roof storm damage?

Coverage depends on your specific policy. Most standard policies cover wind, hail, and hurricane-related damage but may exclude floods or cosmetic-only damage. Reviewing your policy and speaking with a local roofing contractor Gulfport MS homeowners trust can help clarify what’s covered and what’s not.

3. Should I make repairs before the insurance adjuster inspects the roof?

No—only make temporary repairs to prevent further damage (like tarping or boarding up). Permanent repairs before the adjuster’s visit can result in part or all of your claim being denied. Be sure to document all emergency fixes and save your receipts for reimbursement.

4. Can my roofing contractor help during the claims process?

Yes. A reputable roofing contractor MS Gulf Coast homeowners rely on can provide detailed inspections, written estimates, and even meet with your insurance adjuster to ensure nothing is overlooked. This often results in a more accurate—and fair—settlement.

5. What if the insurance settlement doesn’t cover all my roof repairs?

You have the right to negotiate your claim. Provide additional documentation, request a second inspection, or get a revised estimate from your contractor. If needed, you can consult a public adjuster or attorney. The key is not to settle for less than what’s needed to restore your roof properly.