As a homeowner in the MS Gulf Coast Area, one of the most important aspects of protecting your property is having a comprehensive insurance policy that covers potential damages. Roof damage is a common concern, especially in areas prone to severe weather. But when it comes to roof replacement, the big question remains: Does insurance cover a new roof? The answer isn’t always straightforward and depends on several factors, including the cause of the damage, the specifics of your insurance policy, and the age and condition of your roof.

In this blog, we’ll explore when homeowners insurance will cover a new roof in Ms Gulf Coast, the types of coverage you may have, and the exclusions you should be aware of. We’ll also walk you through the process of filing a claim for roof replacement, so you know exactly what to expect.

When Insurance Will Cover a New Roof in MS Gulf Coast

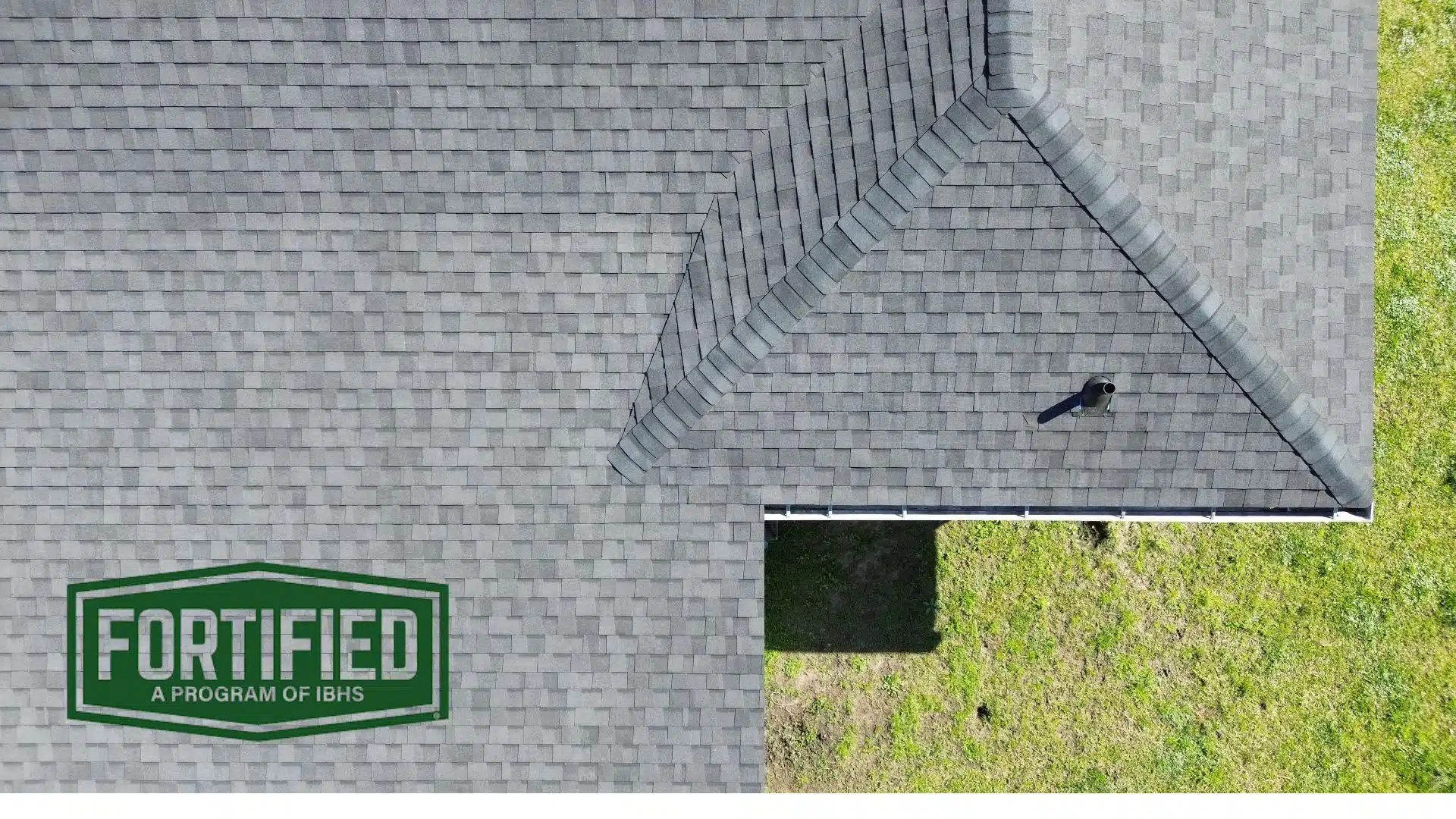

Insurance typically covers roof replacement if the damage is caused by a covered by a hazard. These are events or incidents that are specified in your policy and are typically beyond your control. However, the damage must be sudden and accidental; insurance will not cover roof damage that results from neglect or natural wear and tear over time. If you face this challenge, now would be a great time to upgrade to a Fortified Roof.

Here’s a breakdown of common covered perils:

Covered Hazards:

- Severe Storms (Wind, Hail, Tornadoes):

Severe weather events, including high winds, hailstorms, and tornadoes, can cause significant damage to your roof. These events are typically covered under most homeowners insurance policies, as they fall under natural disasters and weather-related incidents. - Fire:

If your roof is damaged or destroyed by fire, it is usually covered by your homeowners insurance. This includes fire from lightning strikes or other accidental causes. - Fallen Trees or Debris Due to Storms:

When a tree falls on your roof during a storm, or when debris is blown onto your roof, insurance generally covers the damage. The damage caused by this type of event is often sudden and accidental, making it eligible for roof replacement in Gulfport MS. - Vandalism or Accidental Damage:

If your roof is damaged by vandalism, such as a broken window or a structure that was intentionally damaged, or by an accidental event like a car crashing into your home, these damages are typically covered as well.

It’s important to note that in order for the damage to be covered, it must be sudden and unpreventable. Insurance will not cover roof damage that occurs due to neglect, lack of maintenance, or normal wear and tear. For example, if your roof in Gulfport MS has aged and has suffered gradual degradation, your insurance likely won’t pay for a new roof unless the damage is the result of an incident like a storm or fire.

Types of Insurance Coverage for Roof Replacement in MS Gulf Coast

When it comes to homeowners insurance and roof replacement, the type of coverage you have will largely determine how much you can receive to replace or repair your roof. There are two primary types of coverage that insurers typically offer: Replacement Cost Value (RCV) and Actual Cash Value (ACV).

Replacement Cost Value (RCV)

RCV coverage is the more comprehensive option and provides the full cost to replace your roof with a new one of similar quality and type. This means that if your roof is damaged or destroyed due to a covered peril, your insurer will pay to replace it without factoring in depreciation. This is ideal for homeowners who want to ensure they can restore their roof to its original condition.

- How Payments Work: When you file a claim under RCV coverage, you typically receive an initial payment based on the actual cash value (ACV) of the roof. This is essentially the depreciated value, accounting for the roof’s age and condition. Once the roof replacement is completed, you can submit the final invoices and receipts to your insurance company. The remainder of the payment, minus your deductible, is then paid out to cover the full replacement cost of a new roof.

RCV is particularly beneficial if your roof is relatively new or in good condition, as it will ensure you’re fully compensated for the replacement.

Actual Cash Value (ACV)

ACV coverage is a more basic form of insurance coverage that compensates you based on the current value of your roof, factoring in depreciation. This means that you will receive less money for a roof replacement under an ACV policy compared to RCV, as the payout considers the age and wear of the roof.

- How ACV Calculates Payouts: The ACV payout reflects the depreciated value of the roof at the time of the damage, which is typically lower than the original purchase price. For example, if your roof is 10 years old and suffers damage, the payout will be based on the value of the roof after factoring in its age and condition, leading to a smaller settlement.

ACV vs. RCV for Older Roofs

Insurance trends are shifting, particularly when it comes to older roofs. Many insurers are moving toward offering ACV settlements for roofs that are over 10 years old, especially in cases of wind and hail damage. For roofs in this age range, you can expect a significantly reduced payout under ACV policies compared to RCV policies, as the roof’s depreciated value will be lower. This means that if you have an older roof, you may not receive enough compensation to fully replace it under an ACV settlement.

What Insurance Does Not Cover

While homeowners insurance can be a valuable resource for roof replacement, it’s important to understand what is not covered under your policy. There are several exclusions that homeowners should be aware of when it comes to roof damage.

Exclusions:

- Damage from Neglect, Lack of Maintenance, or Normal Aging:

Insurance typically does not cover damage that results from neglect or lack of maintenance. If your roof has deteriorated over time due to insufficient upkeep, or if it has aged and is no longer functioning as it should, this will likely not be covered. Regular maintenance and timely repairs are essential to ensuring that your roof in Gulfport MS remains in good condition and eligible for insurance coverage. - Cosmetic Damage:

Cosmetic damage, such as discoloration or minor surface damage that does not affect the roof’s structural integrity or functionality, is usually excluded from coverage. Insurance policies focus on functional damage that impacts the roof’s ability to protect the home from the elements. - Damage from Excluded Perils:

Certain perils, such as floods or earthquakes, are generally not covered by standard homeowners insurance policies. However, homeowners may be able to purchase additional coverage, known as riders, for these types of events. If your roof is damaged due to an excluded peril and you don’t have supplemental coverage, you’ll be responsible for the repairs. - Coverage Limitations for Roofs Older Than 20 Years:

Roofs that are over 20 years old may face additional challenges when it comes to insurance coverage. Many insurance companies will limit coverage or deny claims for older roofs, especially if they’re near or beyond the end of their typical lifespan. For older roofs, insurance may only provide ACV coverage, not RCV, meaning you’ll receive a lower payout.

Understanding these exclusions and limitations is crucial when filing a claim, as you may need to ensure your roof is properly maintained and check whether you need additional coverage for certain risks.

How to File a Claim for Roof Replacement

Filing a claim for a roof replacement can feel overwhelming, but understanding the process can help make it much smoother. Here’s a step-by-step guide to help you through the process:

Step-by-Step Process:

- Document the Damage:

- As soon as it is safe to do so, take clear photos or videos of the damage to your roof. When you choose Integrity Roofing we do this for you. This documentation will be essential when filing your claim. Be sure to capture different angles and any visible damage to shingles, flashing, and the roof structure. The more comprehensive your documentation, the easier it will be to prove your case to the insurance company.

- As soon as it is safe to do so, take clear photos or videos of the damage to your roof. When you choose Integrity Roofing we do this for you. This documentation will be essential when filing your claim. Be sure to capture different angles and any visible damage to shingles, flashing, and the roof structure. The more comprehensive your documentation, the easier it will be to prove your case to the insurance company.

- Contact Your Insurance Company:

- Once you have documented the damage, contact your insurance company to report the claim. Most insurance companies offer 24/7 customer support for emergencies. When you report the damage, be prepared to provide details such as the cause of the damage (e.g., storm, fallen tree), and the severity of the issue. Your insurer will then initiate the claims process.

- Once you have documented the damage, contact your insurance company to report the claim. Most insurance companies offer 24/7 customer support for emergencies. When you report the damage, be prepared to provide details such as the cause of the damage (e.g., storm, fallen tree), and the severity of the issue. Your insurer will then initiate the claims process.

- Get Estimates:

- After reporting the damage, your insurer may ask you to get repair or replacement estimates from roofing contractors. These estimates will provide a detailed breakdown of the cost to repair or replace your roof. Make sure to hire a licensed and experienced roofing contractor in Gulfport MS to get an accurate and reliable estimate. This is essential for the adjuster to determine the extent of the damage and the cost of repairs.

- After reporting the damage, your insurer may ask you to get repair or replacement estimates from roofing contractors. These estimates will provide a detailed breakdown of the cost to repair or replace your roof. Make sure to hire a licensed and experienced roofing contractor in Gulfport MS to get an accurate and reliable estimate. This is essential for the adjuster to determine the extent of the damage and the cost of repairs.

- Work with Your Adjuster:

- Your insurance company may send an adjuster to inspect the damage. The adjuster’s job is to assess the damage and determine whether it falls under your policy’s coverage. They will use the roofing contractor’s estimates and their own inspection to calculate the payout. It’s important to communicate openly with the adjuster and answer any questions they may have to ensure all damage is accounted for.

- Your insurance company may send an adjuster to inspect the damage. The adjuster’s job is to assess the damage and determine whether it falls under your policy’s coverage. They will use the roofing contractor’s estimates and their own inspection to calculate the payout. It’s important to communicate openly with the adjuster and answer any questions they may have to ensure all damage is accounted for.

- Complete Repairs:

- Once your claim is approved, you can proceed with the roof replacement. Be sure to keep all receipts and documentation related to the repair work. Your insurance company may reimburse you for the cost of the repairs based on the terms of your coverage (RCV or ACV). Submit all required documentation promptly to avoid delays in reimbursement.

- Once your claim is approved, you can proceed with the roof replacement. Be sure to keep all receipts and documentation related to the repair work. Your insurance company may reimburse you for the cost of the repairs based on the terms of your coverage (RCV or ACV). Submit all required documentation promptly to avoid delays in reimbursement.

Key Takeaways

To summarize, here are the key takeaways about homeowners insurance and roof replacement:

- Insurance covers new roofs if the damage is due to a covered peril:

Homeowners insurance will cover roof replacement when the damage is caused by a covered event, such as a storm, fire, or vandalism. However, damage due to neglect, wear and tear, or excluded perils (e.g., floods) is not covered. - The type of coverage you have (RCV vs. ACV) impacts how much you will receive:

Replacement Cost Value (RCV) coverage will cover the full cost of replacing your roof with a new one, while Actual Cash Value (ACV) coverage only compensates you for the depreciated value, which is often significantly lower. - Review your policy and consult with your insurance agent to understand your coverage:

Make sure to fully understand the specifics of your policy, including the types of coverage, exclusions, and limits. It’s always a good idea to speak with your insurance agent to clarify any uncertainties and ensure you have adequate protection for your roof.

By understanding these essential points, you can confidently navigate the roof replacement claim process and make sure you’re fully prepared if disaster strikes.

- When it comes to homeowners insurance and roof replacement, there are several important considerations to keep in mind. Insurance can cover a new roof, but only if the damage is caused by a covered peril, such as severe storms, fire, or vandalism. The type of coverage you have—whether Replacement Cost Value (RCV) or Actual Cash Value (ACV)—will directly impact how much you receive for roof replacement. Additionally, it’s important to understand that damage due to neglect, wear and tear, or excluded perils like floods or earthquakes will not be covered.

- To ensure you’re adequately protected, it’s essential to review your homeowners insurance policy regularly and work with your insurance agent to make sure your coverage is up to date. Having the right coverage, especially for your roof, can save you thousands of dollars when disaster strikes.

- If you’re unsure about the condition of your roof or the details of your insurance policy, consult a roofing professional today! They can help you assess your roof’s condition and guide you through the process of filing a claim. Don’t wait until it’s too late—take action now to ensure your home is protected.

- FAQ Section

- 1. Does homeowners insurance cover the cost of a new roof?

Yes, homeowners insurance can cover the cost of a new roof, but it depends on the cause of the damage. If the damage is caused by a covered peril like severe storms, fire, or vandalism, the insurance company will typically cover the replacement. However, damage due to neglect or normal wear and tear is not covered. - 2. What is the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV) for roof replacement?

RCV covers the full cost of replacing the roof with a new one of similar quality, while ACV only covers the depreciated value of your roof, factoring in its age and condition. RCV provides a larger payout, making it more favorable for homeowners. - 3. Will my insurance cover the roof if it is over 20 years old?

For roofs older than 20 years, insurance coverage may be limited. Many insurers will only offer ACV coverage instead of RCV, meaning the payout will be based on the roof’s depreciated value. In some cases, older roofs may not be covered at all. - 4. Does homeowners insurance cover damage from floods or earthquakes?

Homeowners insurance generally does not cover damage from floods or earthquakes unless you have purchased additional coverage or a rider for those specific events. These are typically excluded perils under most standard homeowners insurance policies. - 5. How do I file a claim for roof replacement through my insurance?

To file a roof replacement claim, start by documenting the damage with clear photos or videos. Contact your insurance company to report the damage, then get estimates from roofing contractors. Work with the insurance adjuster to determine the claim’s eligibility, and once approved, complete the repairs while keeping all receipts for reimbursement.